If You Have Questions Please, Contact Us

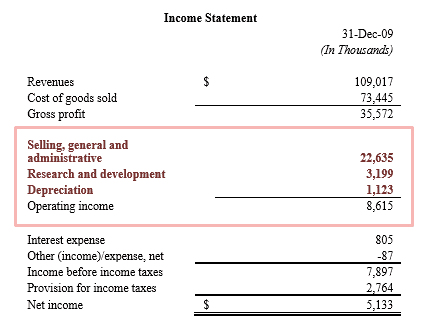

Operating expenses or OPEX refer to the expenditures associated with operating or running a business. They are necessary in order for the company to produce revenues. They are the muscle that makes things happen. Operating expenses consist of selling, general and administrative expenses (SG&A), research and development, and depreciation.

SG&A expenses are expenditures that are not directly tied to a service or product such as overhead costs.

Selling, general and administrative expenses (SG&A) include expenditures such as sales commissions, management salaries, office supplies, advertising, and accounting and legal fees. The amount of SG&A expenses does not mean much by itself but becomes more meaningful when compared either to total revenues or gross profits.

Generally, the best businesses spend fewer revenue dollars on these activities than their competitors do.

Some companies sell such a valuable product or service that they do not have to advertise much because customers do the selling through word of mouth. This is the best kind of advertising because it is free. If, on the other hand, a business is selling a product or service that is just average and people do not really need it, then a significant amount of resources needs to be spent convincing people to buy it.

The cost of goods sold represents the direct expenditures associated with manufacturing a product. These expenditures include the raw materials, labor, and manufacturing overhead. When reselling a product, the cost of goods sold represents the cost of purchasing it from the manufacturer. When the company provides a service instead of selling a product, the cost of goods sold is replaced with another term – the cost of revenue.

What is important to note is that the cost of goods sold only appears on the income statement when the company is actually “selling” or “reselling” its products or services. What if the company is not able to sell its products? The cost of goods sold does not appear on the income statement because the preparation of financial statements of publicly traded companies has to adhere to GAAP (Generally Accepted Accounting Principles). Under GAAP, companies must follow accrual basis accounting, which means that expenses must be matched with corresponding revenues. If the company is not able to sell its products, it does not have any revenues for the corresponding costs to be matched to, and therefore, the production costs are not expensed through the cost of goods sold on the income statement. Investors can prevent unpleasant surprises by monitoring inventory levels on the balance sheet and comparing them to total assets and revenues. A significant accumulation of products in inventory without a similar increase in revenues may mean that the company is unable to sell it products, and as a result, may need to write down the inventory costs through the income statement as a loss without a corresponding increase in revenues.

Operating expenses and cost of goods sold measure various ways in which resources are spent in the process of running an operation.

When an income statement is generated, the COGS and operating expenses are shown as separate line items subtracted from total revenue or sales.

Read More: What is ERP System? What does it stand for and why should your business care about it?

MatixERP is a complete ERP software that is developed with great care to gather everything business managers need in one place.MatixERP helps you transform your business processes to meet today’s needs and tomorrow’s challenges.