Manage Your Restaurant With The Best POS System For Restaurant

Are you struggling to manage your restaurant? Are you tired of keeping track of orders, inventory, and employees manually? Then it’s time to upgrade to a Point of Sale (POS) system. A POS system can help you streamline your restaurant operations, reduce errors, and increase profitability. In this article, we’ll discuss how you can manage your restaurant with the best POS system for restaurant.

What does restaurant Pos software do?

Restaurant POS software is designed to automate and streamline restaurant operations by managing sales transactions, inventory, and other key aspects of the business. It allows servers to take orders quickly and accurately, process payments securely, and manage inventory levels in real time. Additionally, POS software can help with menu management, allowing restaurants to easily update and modify their menu items, prices, and descriptions. With powerful reporting and analytics capabilities, POS software can also provide valuable insights into key metrics such as sales, inventory, and labor costs. Overall, best restaurant management software can be a valuable asset for any restaurant owner looking to improve their operations and increase profitability.

Restaurant pos system features

There are many Restaurant pos system features, such as:

- Streamlining Operations

A POS system can help you streamline your restaurant operations by automating processes such as order taking, payment processing, and inventory management. This can help reduce errors, improve efficiency, and increase productivity.

- Improving Customer Service

Customer service is one of the restaurant pos system features that can help you improve customer service by enabling you to take orders quickly and accurately. It can also provide you with insights into customer preferences and behaviors, allowing you to tailor your offerings to their needs.

- Increasing Profitability

A POS system can help you increase profitability by reducing waste and theft. It can also provide you with insights into your business performance, allowing you to identify areas where you can cut costs or increase revenue.

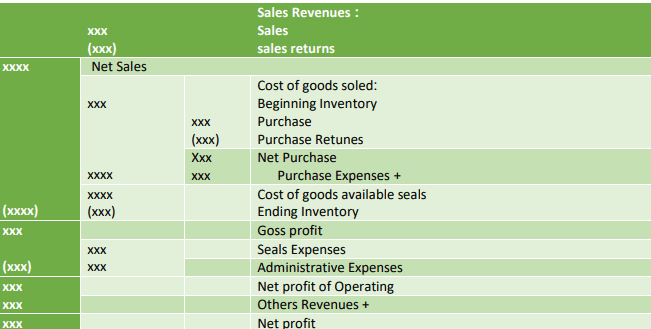

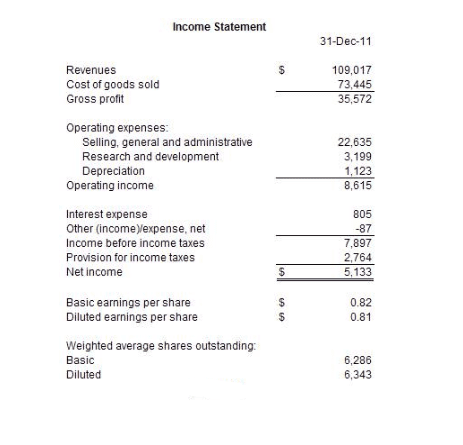

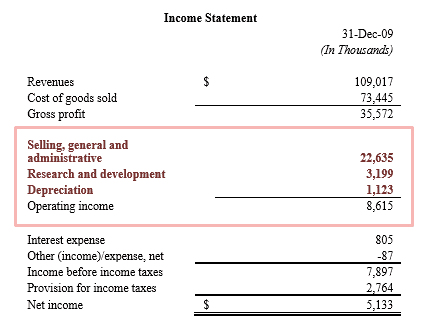

- Simplifying Accounting

Another of the restaurant pos system features is simplifying accounting taxes, and inventory. This can help reduce the risk of errors and save you time and money.

Choosing the best POS system for restaurant

Choosing the best POS system for restaurant can be a daunting task, as there are many options available on the market. Here are some factors to consider when selecting a POS system:

- Features

Make sure the POS system you choose has all the features you need to manage your restaurant. These may include order taking, payment processing, inventory management, customer management, and reporting.

- Compatibility

Compatibility is another important factor to consider when choosing the best POS system for restaurants. It’s important to select a system that is compatible with your existing hardware and software, such as your point-of-sale terminals, payment processing systems, and inventory management tools. This can help to ensure a smooth implementation process and minimize disruptions to your business operations.

- Ease of Use

Ease of use is a critical factor when choosing the best POS system for restaurants. A system that is intuitive and easy to navigate can help to reduce training time, minimize errors, and improve overall efficiency. When evaluating different POS systems, it’s important to consider factors such as the user interface, available training and support resources, and the system’s overall ease of use.

- Cost

Consider the cost of the POS system, including hardware, software, and ongoing support and maintenance. Make sure that the system provides good value for money and fits within your budget.

- Customer Support

Customer support is crucial when selecting the best POS system for restaurants. Look for a provider with a strong track record of customer service and support, with easily accessible resources to help you troubleshoot any issues that may arise.

Best restaurant management software

MatixPOS Restaurant Management a Complete POS with Recipe Management & Food Costing. Having your eyes on business performance anytime and at any POS locations. Manage big or small restaurants or franchises involves operations like billing, inventory, costing, accounting and many more.

- We offer you a cloud restaurant management program, a cloud system that enables you to manage your business and see all the visits that you make through detailed reports that enable you to follow your restaurant or cafe as if you were there.

- You can use the program from anywhere and at any moment.

- It gives you an easy point of sale system that makes you more successful, making it look good.

- Designed by longtime projects in accounting software, accounting software and financial software.

- Sismatix system is integrated with the point of sale system for all types of orders inside the restaurant, or orders that are ordered via call or the Internet, and are prepared and presented inside the restaurant or by home delivery – all of this to manage searches and send orders in an e-mail form. Requests for requests.

- We offer you the most unbeatable and sought after prices.

In conclusion, managing a restaurant can be a challenging task, but a restaurant pos system features can help you streamline operations, improve customer service, increase profitability, and simplify accounting. These are some of the most important restaurant pos system features, When choosing a POS system, it’s important to consider factors such as features, compatibility, ease of use, cost, and customer support. By selecting the best POS system for restaurant, you can take your business to the next level and achieve greater success.